Over the past few months, the Pakistani government has consistently claimed a decline in inflation, stating that the country's inflation rate has continuously decreased. According to data released by the Federal Bureau of Statistics, inflation stood at 1.5% in February 2025, which, according to the government, is the lowest rate recorded in the past 113 months. The Prime Minister termed this decrease “satisfactory,” while government ministers use these figures to assert that inflation is reducing in the country. However, ordinary Pakistani citizens, unfamiliar with complex economic terms, are questioning why the prices of essential goods have not decreased if inflation is truly declining. In other words, why is the cost of living still high? The simple answer is that a decline in inflation does not mean that prices are going down. Instead, it means that the rate of price increase is slowing down—prices are still rising, just at a slower pace than before. Economists point out that despite this positive indicator, a crucial factor remains the purchasing power of the common citizen, which has weakened compared to the past. This means that people can no longer afford to buy as much as they used to, leading to a drop in demand for goods. As a result, businesses struggle to sell their products, negatively impacting the country's overall economic growth. Experts also argue that the decline in inflation is not necessarily due to any government policy but rather the result of shrinking consumer demand in the market, driven by the reduced purchasing power of Pakistanis.

In Pakistan, the terms inflation decline vs inflation rate and price hikes (Mehngai) are often confused, mainly due to a lack of awareness about basic economic concepts. Economist Dr. Aamir Zia stated that the term monetary policy and inflation trends is primarily used in government discourse, whereas the general public understands and uses the term inflation reduction, misunderstanding. For ordinary people, price stability vs inflation control simply means an increase in the prices of goods, while inflation is an economic indicator and inflation management term. He explained that the government measures inflation using a specific index called the Consumer Price Index (CPI). “This index includes selected goods and their prices, and the inflation rate is determined based on the increase or decrease in the prices of these goods.” Dr. Aamir further stated, “The government claims that the sharp rise in inflation rate misinterpretation is slowing down. However, the real issue for the public is that their incomes and purchasing power have significantly declined over the past few years. As a result, even though inflation is decreasing in statistical terms, people are unable to feel any real relief.”

Economists say that one of the reasons for the decrease in inflation is the decrease in the purchasing power of the common people

Economist and Chief Economist of the Bank of Punjab, Saim Ali, while speaking, stated that in Pakistan, the inflation basket is calculated by taking the average price fluctuations of various goods. He explained that the Consumer Price Index (CPI) does not only include food items but also factors in clothing, healthcare, education, housing rents, and transportation costs. He added, "If we exclude food and fuel prices and analyze inflation, it remains around 9%, which means that for the general public, the inflation rate in sectors like education, healthcare, and housing rents remains high." According to him, "This is why, while the rate of increase in food prices has slowed, the prices of other essential goods continue to rise. As a result, any relief people feel in one area is overshadowed by increasing costs in others."

Economist Dr. Qaiser Bengali also supports the notion that inflation has not decreased but rather that its rate of increase has slowed. Providing an example, he explained, "If a product’s price increased from 100 to 200 rupees last year, it meant a 100% price increase. Now, if this year, the price rises from 200 to 300 rupees, the increase is 50%. This means prices are still rising, but the rate of increase is 50% lower compared to the previous year." Dr. Bengali attributed the decline in inflation to a base effect, stating, "Last year saw an extraordinary rise in prices. This year, while prices are still increasing, their rate of increase appears lower when compared to the previous year."

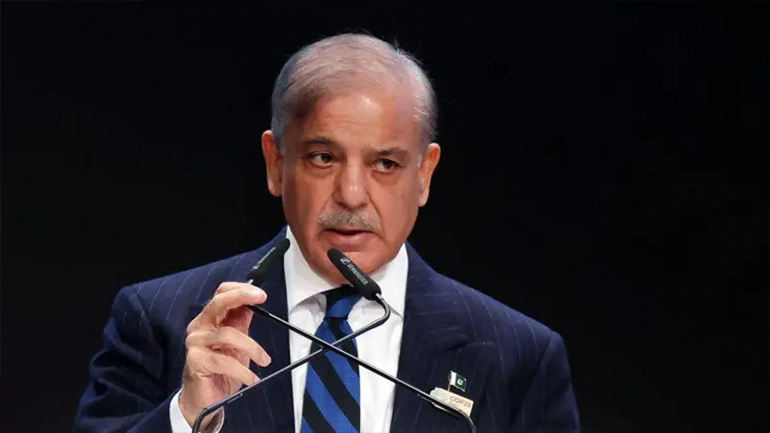

The Pakistani government has expressed satisfaction over the impact of inflation reduction. However, economists argue that this is not a good sign for inflation and economic growth, as the decrease in inflation is due to a decline in people's purchasing power. Dr. Qaiser Bengali stated, "This situation should not be celebrated but rather be a cause for concern because the reduction in inflation is a result of falling demand. People's incomes have shrunk due to unemployment, salary reductions, or the continuous rise in the prices of goods. The inflation decline effects are evident in the struggles of ordinary citizens." It is worth noting that at the end of January 2025, India's inflation rate stood at 4.3%. Dr. Bengali claimed that in recent months, monetary policy and inflation trends in developed economies have shown an increase of up to 3%, while in countries like Pakistan, it should ideally be around 5%. He explained that "An increase in inflation would indicate that demand for goods exists in the market and that people have purchasing power, which ultimately contributes to GDP." "When demand is present, growth occurs in the productive sectors of the economy, ultimately contributing to overall economic growth. However, the opposite is happening in Pakistan. Due to economic contraction, unemployment has risen, and people's incomes have declined, reducing their purchasing power. As a result, they can no longer afford to buy goods, leading to a drop in demand and, consequently, a decline in inflation. The economy after the inflation drop is now facing severe challenges." Dr. Bengali further added, "A drop in inflation to this level (1.5%) indicates that the economy is in poor health, with neither growth nor an increase in people's incomes. Price stability and economy are interconnected, and Pakistan's situation reflects economic stagnation rather than stability." Economist Shahid Mehmood also weighed in, stating that "Pakistan is currently facing a serious unemployment crisis." He pointed out that since 2018, Pakistan has been experiencing a continuous decline in purchasing power due to the slow pace of economic growth. This reinforces the critical link between inflation control and GDP, showing that inflation management alone is not enough for economic stability.

"Inflation falling to this level (1.5 percent) means that the economy is sick and neither growing nor increasing people's incomes."

Powered by Froala Editor