How to do Binance SPOT Trading and Earn Money

In this comprehensive guide, we'll delve into the world of SPOT trading on Binance, providing step-by-step instructions about “How to do SPOT trading” using mobile. From understanding the basics of working in binance Spot is your roadmap to success in the cryptocurrency market.

The motivation to engage in trading on Binance stems from several key factors. Firstly, Binance is renowned as one of the largest and most trusted cryptocurrency exchanges globally, providing users with access to a vast array of digital assets and trading pairs. Additionally, SPOT trading on Binance offers unparalleled liquidity, enabling traders to execute transactions swiftly and efficiently. Moreover, the exchange boasts competitive fees and a user-friendly interface, making it accessible to traders of all levels of experience. Furthermore, the cryptocurrency market's inherent volatility presents ample opportunities for profit, enticing individuals seeking to capitalize on price fluctuations. Ultimately, the combination of Binance's reputation, liquidity, accessibility, and profit potential serves as a compelling motivation for traders to participate in the platform's SPOT trading activities.

Spot trading offers a straightforward and efficient way to participate in the cryptocurrency market, making it an attractive option for those looking to profit from digital assets without the complexities of derivatives trading.

First, navigate to the spot trading window after logging in to the account

The following window will appear:

There are many kinds of orders we can do for the trading in SPOT market that are:

Market Order

Limit Order

OCO

In which you will do the order on the current market value of the coin for example we wanted to buy a coin on current market value. For this first navigate to the SPOT trading window:

Scroll down to the order area and select the market tab

To buy the BTC enter the amount in the amount tab and click on buy as shown below in the screenshot also notification will be displayed in the top right corner.

To sell the BTC enter the amount in the amount tab and click on sell as shown below in the screenshot also notification will be displayed in the top right corner.

To make a limit order we just need to switch the tab from the market to limit then two options will be displayed for the values to be entered that is price and Amount you need to just add the target value in the price where you are expecting the price will be go and in the Total section you can add the value of the USDT which are you going to buy/sell and then click on the buy button so that the order will be placed and when the limit will meet then the order will complete of buy or sell.

To make the sell order first go to the price section input the target limit amount to sell in the price section and the amount to sell on that limit point and then click on the sell BTC button.

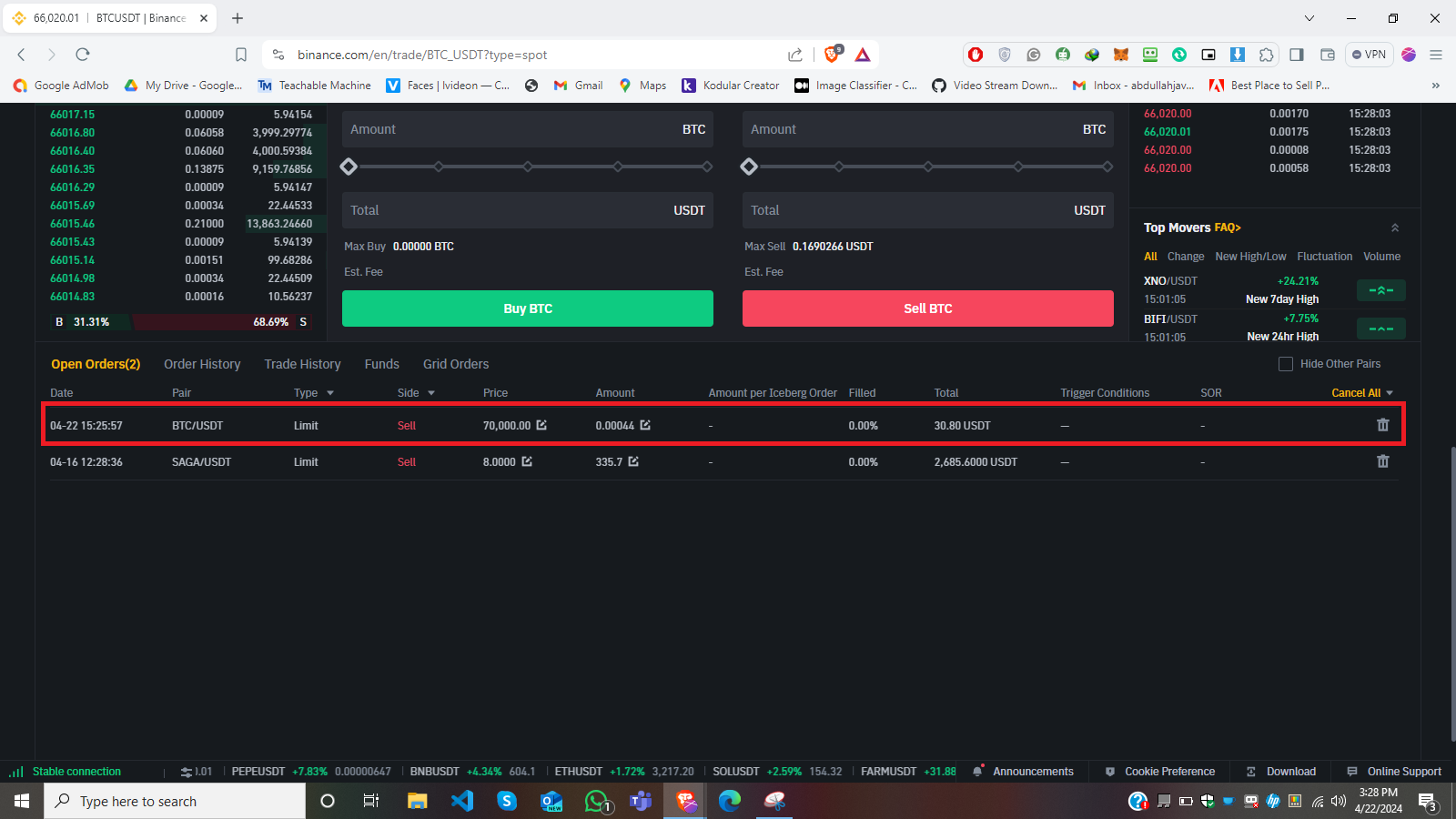

The order will be updated in the below Order list highlighted where you can see your order in the queue and when it reaches its limit then the order will be completed and the amount will be sold.

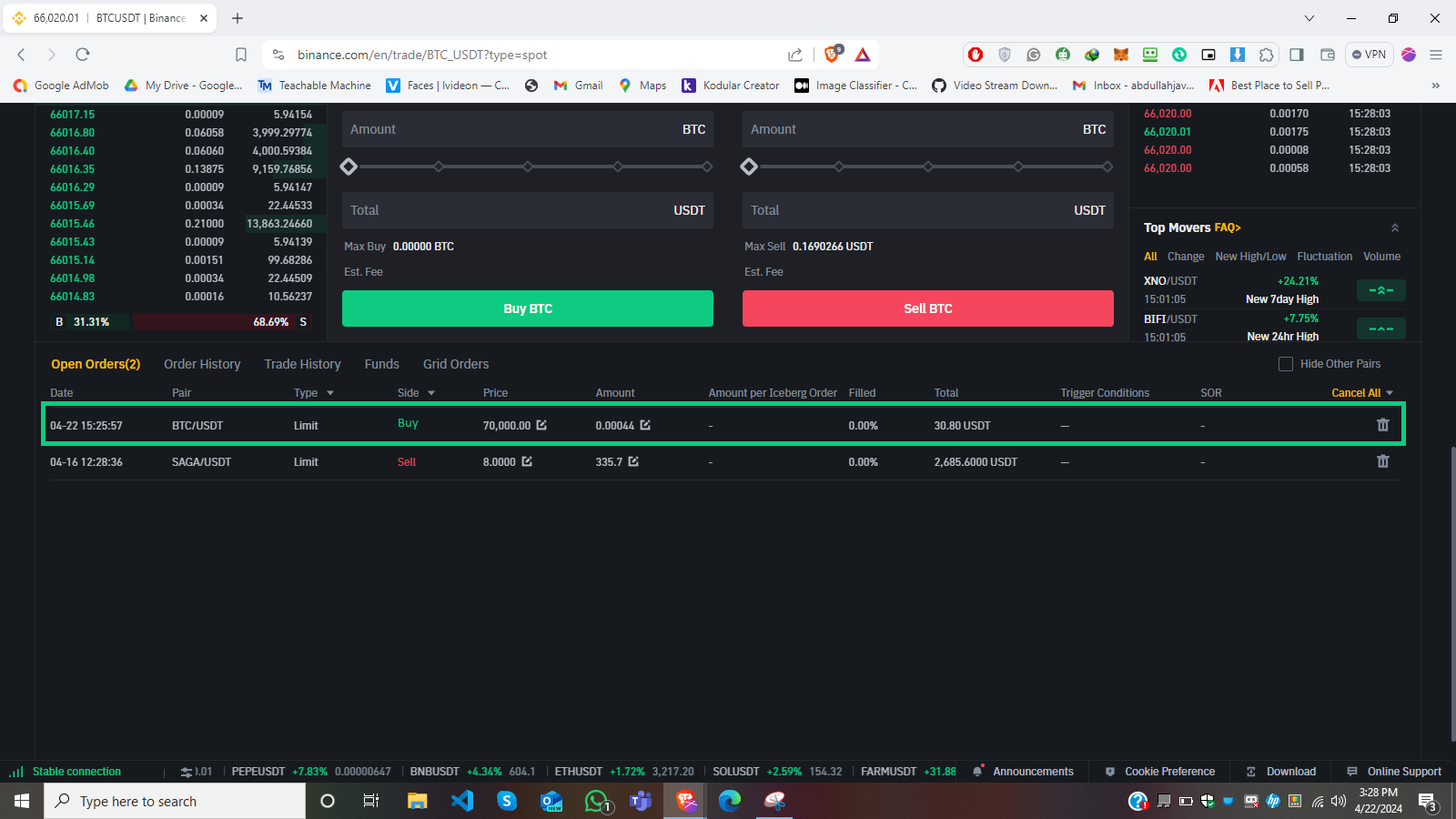

Also for doing buying in trading just need to switch the value to the buy side and enter the target Price value of the buying enter the amount of the value to buy and click on buy the order will be updated into the below list

The order can be seen in the screenshot below

OCO stands for "One Cancels the Other." It's a type of advanced order that allows traders to set up two linked orders simultaneously. When one of the orders is executed, the other order is automatically canceled, hence the term "one cancels the other". Here's how an OCO order works:

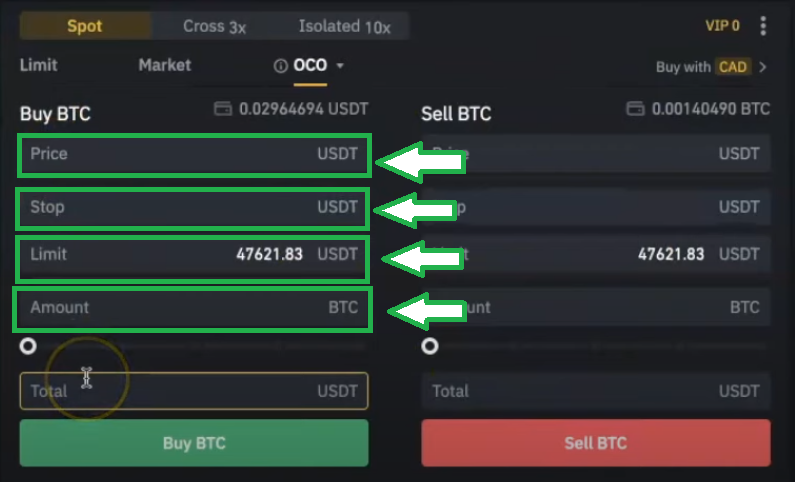

Go to the OCO section in the stop limit drop-down menu

In an OCO order, you specify two different orders: a "primary" order and a "secondary" order.

The primary order is the initial order you want to execute, such as a buy or sell order.

The secondary order is an accompanying order that is contingent upon the execution of the primary order.

Below you can see the window in which you can see the Target price on the top that you are targeting the price will go and if it drops below the stop value then this will cancel the order and if the price will reach that target price then this will buy the crypto.

The secondary order is immediately canceled if the original order is carried out. As an illustration, suppose you designate a sell limit order as the secondary order and a buy limit order as the primary order: Should the price drop and initiate a purchase order, the sale order will be instantly canceled. Setting up simultaneous stop-loss and profit-taking orders is helpful in this case.

If the secondary order was triggered before the primary one, if the secondary order was met, the primary one will be removed. If the primary order were to be a sale on a condition, and the secondary purchase on a condition, and in the case the rate and price rose enough to force the sale on the condition proposed, the purchase conditions would be removed, and vice versa. This particular scenario might be useful if you aim to stake a purchasing position when the price started to rise and your selling position once the price started to drop simultaneously.

In essence, OCO orders allow traders to manage risk and potential profit simultaneously by linking two orders together, ensuring that only one of the orders is executed while the other is canceled automatically. This advanced order type is commonly used by traders who want to implement multiple trading strategies or manage their positions more effectively in volatile markets.

Limitations: Acknowledgment of the risks involved in cryptocurrency trading, including market volatility and regulatory uncertainty.

Recommendations: Encourage readers to continue learning and practicing trading strategies, as well as seek advice from experienced traders or financial professionals.

Powered by Froala Editor