The International Monetary Fund (IMF) has imposed some new conditions, along with urging the implementation of earlier ones, under its $7 billion Pakistan Extended Fund Facility (EFF) loan program as part of the broader IMF loan conditions for Pakistan. It is worth noting that, recently, the international institution released the second tranche of $1.2 billion to Pakistan under this loan program, reflecting the ongoing IMF and Pakistan's economic policies. In the review report of the staff-level agreement released on Saturday, the IMF assessed the program, its conditions, and their implementation while also introducing new requirements to ensure its continuity through compliance, marking a significant phase in the IMF economic reforms and the IMF's new conditions for 2025. In its new report, the IMF has imposed 11 new conditions related to IMF governance reforms in Pakistan and the broader economy, while also emphasizing the need to implement some of the earlier conditions, with a set timeline for their fulfillment. According to journalists and experts covering IMF affairs, the primary purpose of these new conditions is to maintain financial discipline in Pakistan to reduce Pakistan's fiscal deficit. However, according to experts, these conditions also impact government sectors and the daily lives of ordinary Pakistanis, showing the impact of the IMF program on the Pakistani economy. Among other conditions, the IMF has also allowed some relaxation regarding the used car import policy in Pakistan, which is expected to significantly affect their prices. Let’s first take a look at what these 11 conditions are.

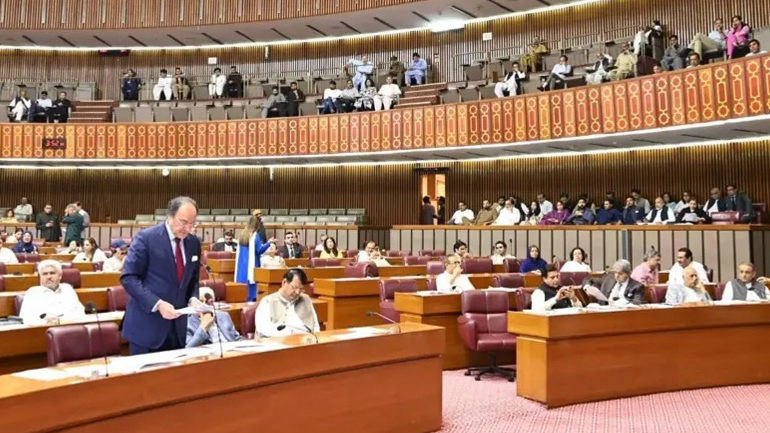

In the report issued by the International Monetary Fund (IMF) for Pakistan, 11 new conditions or proposals have been set, which Pakistan is required to implement to ensure the continuation of the loan program. At the top of the list is the demand that Pakistan’s new fiscal year budget be prepared under the IMF staff-level agreement and passed by the parliament. According to the IMF conditions, parliamentary approval of the fiscal year 2026 budget must be secured by the end of June 2025, in line with targets agreed with the IMF. The second condition calls for a comprehensive plan to impose a new tax on agricultural income, which should include return filing, taxpayer identification, registration, awareness campaigns, and strategies to improve compliance. The deadline for this is set for June 30, 2025. The third condition requires the government to publish a Governance Action Plan aimed at addressing major weaknesses in state institutions. The fourth condition pertains to the Benazir Income Support Programme, demanding that cash assistance be increased annually in line with inflation to preserve purchasing power. The fifth condition asks the government to publish a long-term fiscal strategy post-2027, which must include the institutional and regulatory framework beyond 2028. In the energy sector, four new conditions have been imposed:

First, the government must issue a notification by July 1 for an annual revision of electricity and gas tariffs to ensure they remain cost-reflective.

Second, a notification for semi-annual gas tariff adjustments must also be issued.

Third, the parliament must pass legislation by the end of this month to convert the Captive Power Levy Ordinance into permanent law.

Fourth, another legislative requirement is to remove the cap on the debt repayment surcharge in electricity bills, with a deadline set for the end of June.

In the sectors of trade, investment, and deregulation, the IMF has made two further demands:

The first is that Pakistan must prepare a plan to phase out all incentives given to Special Technology Zones and other industrial zones by 2035. This plan must be finalized by the end of the year.

The second demands that Pakistan pass legislation in parliament to lift the ban on the commercial import of used cars, specifically those less than five years old, by the end of July.

Senior journalist Mehtab Haider, who covers IMF and Pakistan-related affairs, told the that this is a very important condition and that it is the first time such a condition has been introduced, requiring that the new budget be prepared under the IMF staff-level agreement. He stated that this means the new budget must be structured in a way that all the targets agreed upon in the staff-level agreement can be achieved. Mehtab Haider explained that in this context, the primary budget, which excludes debt repayments and interest payments, will need to be in surplus. To achieve this, revenues must be increased and expenditures must be reduced. He further noted that while the defense budget is unlikely to be reduced, cuts may be made to the development budget. Similarly, it appears that the government may refrain from announcing large-scale development projects in the upcoming budget. The government may make announcements, but under the current circumstances, it seems unlikely that these projects will be initiated or completed.

The IMF’s conditions for the electricity and gas sectors include an IMF electricity tariff review and gas and electricity price adjustment, with an annual review of tariffs in these sectors, as well as reducing the ceiling on the debt surcharge on electricity bills, which is currently 3.21 rupees per unit. This condition must be fulfilled by the end of June. Analyst Mahtab Haider explained that “the purpose of these IMF energy sector reforms in the electricity and gas sectors is to cover the cost of production. Due to the incomplete recovery of electricity and gas costs in Pakistan, circular debt in the energy sector has reached several hundred billion rupees.” Mahtab Haider added, “Gas price increase in 2025 is likely, which could lead to rising utility costs in Pakistan and higher bills for consumers. According to him, removing the cap on the debt surcharge may also result in electricity bill increases due to the IMF.”

The impact of IMF conditions on utility bills has been a major concern. Why India failed to stop the IMF from releasing a loan tranche for Pakistan. Legal status of non-custom paid vehicles and their connection to rising crime in Pakistan. Why has a tax been imposed on agricultural income in Pakistan, and what income will the ‘super tax’ apply to? US weapons left in Afghanistan were bought on the black market by Al-Qaeda-linked groups. Energy sector expert Rao Amir Ali told the, “The IMF’s condition for an annual review of tariffs on electricity and gas requires Pakistan to comply because the country already conducts annual tariff reviews for both.” According to him, “An energy tariff hike in Pakistan is unlikely, and a slight decrease is expected. The removal of the cap on the surcharge aims to recover loans taken from banks to manage circular debt by increasing the surcharge if interest rates rise, thereby preventing further growth of circular debt in the electricity sector.” These developments may also lead to power sector subsidy cuts, putting more pressure on end consumers.

The Used car import policy in Pakistan has come under review as the IMF has directed Pakistan to lift the ban on the commercial import of used vehicles through legislation in parliament. This move is part of the IMF’s broader trade liberalization demands, specifically aimed at the relaxation of used vehicle import restrictions for cars that are less than five years old. This legislation must be passed by the end of July. According to the IMF, the purpose of this measure is to promote free trade. Chairman of the All Pakistan Motor Dealers Association, H.M. Shehzad, told the BBC that “allowing the import of vehicles between three to five years old will lead to cheap imported cars in Pakistan.” He explained that if a three-year-old car costs $3,000 to import, a five-year-old car could be imported for around $1,400 to $1,500, which would benefit ordinary people. Automotive sector expert Mashhood Ali Khan commented that whether cars become cheaper under this IMF condition depends on how much the dealer reduces the price. He added that most such vehicles are used Japanese cars in Pakistan, imported primarily from Japan. However, he also warned that “this move could severely impact the auto parts industry in Pakistan because vehicle manufacturers may opt to import complete cars from abroad and sell them, while the local auto industry could suffer negative consequences.” This highlights the local auto industry challenges resulting from the IMF reforms. Director General of the Pakistan Automotive Manufacturers Association (PAMA), Abdul Waheed, said that the association plans to raise this issue with the government. However, he acknowledged that this IMF condition would likely hurt the local car manufacturing industry, affecting car prices in Pakistan in 2025 and beyond. It’s worth noting that, according to the FBR, anyone in Pakistan can currently import a new car by fulfilling all legal requirements, including paying duties and taxes. However, importing used cars typically requires reliance on overseas Pakistanis. The most used Japanese cars in Pakistan are imported under the gift scheme. According to the Import Policy Order 2022, vehicles older than three years cannot be imported at the moment. Under the gift scheme, overseas Pakistanis can gift a car to immediate family members (parents, siblings, children, spouse). The associated duties and taxes must be paid in foreign currency, in line with the existing used car import policy in Pakistan.

All four provincial assemblies in Pakistan have already enacted legislation related to this agricultural income tax in Pakistan. However, the IMF tax reforms require that by the end of the current fiscal year, Pakistan must establish a proper mechanism for the collection of agricultural tax. According to Dr. Ikramul Haq, a tax expert, “Although the laws have been passed, the provinces are still lagging in implementation.” He added, “Punjab is the largest province where the tax on the agriculture sector is expected to generate the most revenue, but the tax rates have not even been determined yet.” He further stated, “The agricultural tax return filing system is in English, which is confusing for ordinary farmers and landowners. The IMF demands that this agricultural tax policy 2025 mechanism be in place by June 30, but there has been little progress so far.” According to him, while broadening the tax base in Pakistan through the inclusion of the agriculture sector is necessary, the threshold of Rs 600,000 income for taxation could be financially challenging for small farmers and landowners. He said that the cost of farming has increased, and now farmers must bear these rising costs while also paying taxes, which could worsen their financial difficulties.

Among the 11 new IMF conditions for Pakistan, the requirement to disclose civil servants' assets is not a direct condition, but it is one of the emphasized recommendations. The international financial institution had initially set a deadline of February 2025 for this civil service asset disclosure, but due to a lack of implementation, the IMF has now extended the deadline to the end of June. Tax expert Dr. Ikramul Haq explained that this condition primarily falls under the category of governance and transparency reforms, and it targets officers in grades 21 and 22 of the Pakistani civil bureaucracy. He noted that the IMF had suggested that the assets of both military and civil service officers be made public, but initially, the focus is on the public declaration of assets by senior civil servants.

Powered by Froala Editor