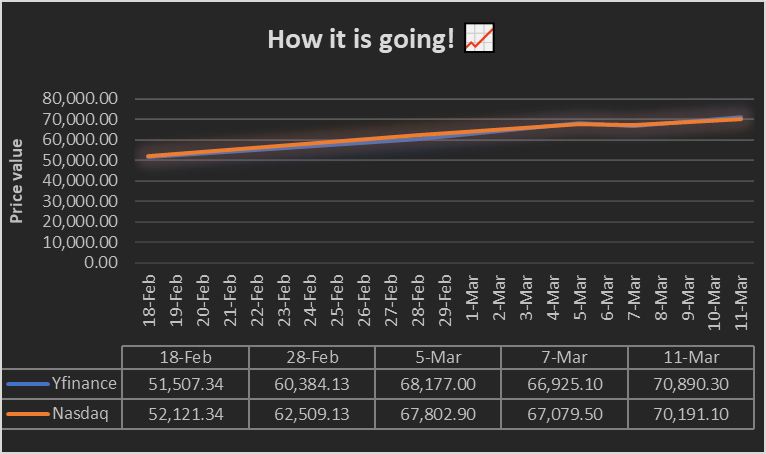

Alarming Alert for all the crypto investors, traders, and research enthusiasts! According to NASDAQ, Bitcoin, the world’s oldest and most popular cryptocurrency, traded above $62,509 on 28th February 2024, breaking free from more-than-two-year slump that had put the future of the entire crypto ecosystem in question and here it is important to remember that Bitcoin hit its peak at almost $69,000 on 11th November, 2021. Now, the burning question is: Are we witnessing a déjà vu?

What is Bitcoin?

Alright, before we dive in, let's take a quick spin through the backstory of Bitcoins. In 2008, a mysterious figure named Satoshi Nakamoto dropped a game-changing white paper on us. The idea? Bitcoin – a digital currency that lets you send money directly from one person to another, no banks involved. Bitcoin's secret sauce is the blockchain – a super-secure online ledger that watches over every transaction like a digital watchdog. To keep things safe, they use cryptography, creating a secret code for all digital transactions. Now, enter the unsung heroes – bitcoin miners. These tech whizzes use special gear to solve puzzles and bundle transactions into unbreakable blocks. As a reward, they earn shiny new bitcoins. It's like a high-tech treasure hunt, and these miners are the champions of the cyberworld!"

What triggered the dramatic collapse of cryptocurrencies in the past?

Once upon a time, Bitcoin was riding high back in November 2021. It was like the rockstar of currencies. But then, the spring of 2022 hit, and it was like the ultimate plot twist. Some big-shot crypto companies turned out to be scams, leaving folks who bet their savings on crypto with empty pockets. The drama reached its peak in November 2022 when FTX, a major crypto exchange, crumbled like a house of cards, costing customers a whopping $8 billion in the process.

What led to Bitcoin's comeback?

Fast forward to today, Bitcoin has made an epic comeback and this big comeback wasn't just luck – it had a superhero moment in August. A court ruling opened the floodgates for financial wizards to create something called exchange-traded funds (E.T.F.s). Now, these aren't your typical investments – think of them as baskets full of crypto goodies, divided into shares. So, instead of diving headfirst into the crypto world, folks could now just buy shares in these E.T.F.s.

Why is this a big deal? Well, it's like a crypto cheat code for cautious investors. No need to fuss with digital wallets or take risks with sketchy start-ups. They can dip their toes in the crypto pool without the hassle. And guess what? Since these E.T.F.s hit the scene in January, more than $7.5 billion has flowed into them. And it seems like bitcoin is writing its redemption story.

Find yourself wondering if this is the same wild ride as 2021?

Bitcoin's early years were like a thrilling rollercoaster, with steady growth and wild price surges called 'bull runs.' In the chaotic crypto tale of 2021, Bitcoin hit a jaw-dropping $69,000 during one of its epic bull runs. But hold on, it wasn't always sunshine and rainbows.

Around 2014 and 2017, Bitcoin faced some drama. Enter the 'forks,' causing a bit of chaos and splitting the Bitcoin community. Forks are like turning points in Bitcoin's story, where different groups wanted to steer it in various directions. Despite the chaos and debates, Bitcoin stood strong. Surviving these challenges boosted its confidence and strength. Those forks? Now just a blip on Bitcoin's radar, making up less than 1% of its total value.

Fast forward to 2023, when big shots like BlackRock decided to throw an exclusive party for Bitcoin – an exchange-traded fund (ETF). WisdomTree, ARK Invest, and others joined the celebration. In January of that year, the U.S. gave the green light to 11 ETF applications, causing Bitcoin to soar past $52,000 in just a month. These ETFs became the rockstars of the financial world, attracting massive investments, second only to gold.

Now, let's chat about Bitcoin's 'halving' event – a four-yearly party that slows down the creation of new coins. The next one is expected in May this year. Some folks think it's a big deal, leading to significant price jumps before and after the event. But our expert, Sciberras, says, "Hold on, the jury's still out on how big of a deal this halving really is." Some even think it's not the main event, suggesting it's more about syncing up with other financial cycles.

So, "This time around, it's a different game," explains Michael Anderson from Framework Ventures. "It seems like the big players are steering the ship – a bit like a crypto blockbuster led by the pros." In simpler terms, the crypto story is evolving, and the major players are now calling the shots.

Is crypto really back?

Crypto fans say, 'Hell yeah!' They predict Bitcoin might skyrocket past $100,000. But hold on – it doesn't mean the whole crypto gang is out of the woods. Government folks aren't exactly throwing a crypto party; they're cool with Bitcoin but giving the stink-eye to other digital currencies.

The SEC (Securities and Exchange Commission) is suing Coinbase and other big players, and the outcomes could decide if the U.S. keeps its crypto groove. So, is it a comeback? We'll see, my friend, we'll see."

Will bitcoin hit $100,000 this month! How, you ask?

Right now, it's like there's a sale going on – a Bitcoin buffet. If eager traders jump in and grab some while it's on discount, we could be in for a wild ride. Forget the complicated stuff; let's look at the big numbers, like $60,000, and if that's breezed through, we're eyeing $65,000, $75,000, $85,000, and the grand $100,000. Why is this even possible? Well, history says that when Bitcoin breaks its own best scores, it goes into overdrive. Back in 2020, it shot up like a rocket after beating its 2017 high of $19,800, hitting an amazing $65,000. So, could we see a similar show this time? Signs point to yes, with good things happening like more people wanting Bitcoin (ETF demand) and a cool thing called halving. Get ready; Bitcoin might be making big news at $100,000 this very month!"

Unpacking the Bull and Bear Scenarios: What Lies Ahead for Bitcoin?

The Bullish Outlook: Imagine Bitcoin as a financial superhero ready to tackle economic challenges. According to experts, if traditional banks keep stumbling and the US faces more economic hiccups, Bitcoin might emerge as the hero we didn't know we needed.

In this bullish scenario, if banks keep struggling in 2024, the government might step in, printing more money and devaluing the US dollar. Enter Bitcoin, the known, fair, and resilient asset with a fixed supply. It could become the go-to safe haven amidst economic storms, much like it did during the Covid-19 pandemic.

But that's not all. Recent innovations on the Bitcoin network, like ordinals and BRC-20 tokens, are turning heads. Increased demand for block space and the Lightning Network speeding up transactions might transform Bitcoin from just a store of value to a legit payment method. If this trend continues, those lofty price targets for Bitcoin might not be so far-fetched.

And guess what? Spot Bitcoin ETFs getting the green light is a game-changer. It's not just boosting prices but also making cryptocurrency more legit in the eyes of big players. The potential influx of billions into Bitcoin through these ETFs is like fueling the crypto rocket.

Lastly, new rules around reporting digital assets for companies, set to kick in by December 2024, could make holding Bitcoin on balance sheets a breeze. It's like the regulatory hurdles are getting a little lighter for companies diving into the crypto world.

The Bearish Side of the Tale: Now, every superhero has its kryptonite, and for Bitcoin, it's not all sunshine and rainbows. The decreasing block reward raises concerns about Bitcoin's long-term security. Imagine it as a ticking clock, counting down to potential challenges.

Short-term sell pressure is another cloud hanging over Bitcoin's sunny skies. Plus, there's a heated debate about 'inscriptions' on the Bitcoin blockchain. Some see them as valuable additions, while others, like Bitcoin developer Luke Dashjr, call them spam. It's like the Bitcoin community has its own internal clash of ideologies.

Environmental concerns are also casting shadows. The White House proposing a tax on Bitcoin miners and ongoing criticism about energy consumption could pose threats to Bitcoin's price. If governments turn their backs on Bitcoin due to environmental or political reasons, it could lead to a downturn.

Speaking of governments, the US is giving off some unfriendly vibes toward cryptocurrency. A recent bill with stricter reporting requirements for digital currency transactions might not bode well for the US crypto industry. Anti-money laundering (AML) and Know Your Customer (KYC) laws are causing some sleepless nights for investors too.

In a nutshell, the future of Bitcoin is like a gripping drama with both exciting highs and nerve-wracking lows. Will it soar to new heights, or will it face formidable challenges? Only time will tell, and the crypto world is holding its breath for the next twist in this captivating tale.

The age-old question persists: to invest or not to invest in Bitcoin?

When the day winds down, one thing remains: the ongoing confusion. People can't agree on Bitcoin. Some say it's like the superhero of finance, a huge leap forward. Others call it the ultimate scam, the biggest one ever. Let's hear what the experts on both sides have to say.

First off, there's Warren Buffett, the money guru. He's not exactly throwing a Bitcoin party. Why? According to him, Bitcoin doesn't do anything useful. In 2022, he joked that he wouldn't trade $25 billion for all the Bitcoin out there because, in his words, it "isn't gonna do anything." Burn!

On the other team, we've got Fidelity, the heavyweight in finance. They're giving Bitcoin a high-five. In 2023, they rolled out Fidelity Crypto, letting people trade Bitcoin like it's the hottest thing. Their researchers even called Bitcoin the cool kid on the digital block, saying it's the most "secure, decentralized, sound digital money." Big thumbs up!!

Now, meet Michael Novogratz, a finance big shot. He's been the Bitcoin cheerleader for ages. In late 2023, he confidently predicted Bitcoin would reach new highs and nailed the call on the SEC approving a Bitcoin ETF. According to him, there's a bunch of good vibes happening to Bitcoin.

Alright! Now here’s Robert Kiyosaki, a legend in the finance for his influential book "Rich Dad Poor Dad," recently shared a powerful insight. In a post, he exclaimed, "BITCOIN on fire. The biggest mistake you can make is to procrastinate. Important to start, even if only for $500. Next stop $300,000 per BC in 2024."

Kiyosaki's words underscore the urgency he sees in seizing the current momentum of Bitcoin, emphasizing that even a modest starting investment can potentially lead to substantial returns. His prediction for Bitcoin hitting $300,000 per unit in 2024 adds an intriguing layer of anticipation to the evolving cryptocurrency landscape. So, there you have it – the love, the doubt, and the hope in the Bitcoin world, where opinions are as diverse as the digital coins themselves!"

Predicting Price Pulse: What Will Set the Beat?

Get ready for the bullish joyride! Bitcoin's journey in 2024 promises a thrilling ascent. With more Bitcoin services and a global embrace, our analysts forecast highs at $60,315.37, lows at $54,625.24, and an average of $51,211.17 for BTC. In 2025, community power propels Bitcoin's value. Picture a bullish scenario with a peak at $83,075.89, an average of $78,068.58, and a base at $72,833.66. Curious about 2026? Bitcoin's future could be extraordinary. Projections include a peak at $104,698.39, an average of $100,601.49, and a base of $94,456.15.

However, in the unpredictable crypto seas of 2027, Bitcoin might hit a max at $126,320.88, average at $121,768.78, and a low at $116,078.65. Initiatives and partnerships might be the compass. By 2028, ride the wave with projections at $149,081.40 (peak), $143,391.27 (average), and $137,701.14 (base) in a bullish market. Sure thing! 2029 whispers transformation! $170,703.91 a peak, $166,151.79 an average, and $159,323.64 is a base predicted value.

Long-term holders rejoice! In 2030, Bitcoin might peak at $192,326.39, average at $186,636.26, and base at $180,946.13. Fast forward to 2040! Projections hint at $569,240.60 (peak), $557,632.74 (average), and $542,838.40 (base). Bitcoin's saga continues! By 2050, predictions sway towards $1,194,927.30 (peak), $1,160,786.52 (average), and $1,110,713.37 (base). The crypto journey persists, marked by growth and adoption.

As we wrap up our journey through the future of Bitcoin, it's like navigating uncharted waters with a treasure map in hand. The predictions from 2024 to 2050 paint a dazzling picture, with Bitcoin reaching heights like $143,779.60 in 2028. But, hold on to your hat—crypto waters can be choppy!

A Final Farewell Note: Is Bitcoin's Journey a Tale of Fortune or Folly?

In this grand finale, a friendly reminder: Cryptocurrency is a wild ride, and caution is your trusty compass. While the forecast is exciting, the market can be as unpredictable as a rollercoaster. So, before you set sail on the crypto sea, do your homework. Research those projects, networks, and assets—know your stuff!

So, what's the bottom line? Bitcoin's future is brimming with promise. Whether you're a crypto pioneer or a curious onlooker, this is a time of incredible growth. But, and it's a big but, always treat predictions like helpful suggestions, not sacred truths. Be wise, consult with financial buddies, and dive into the crypto adventure with your eyes wide open.

Key takeaway: On the thrilling tale of Bitcoin's rollercoaster ride, from a shocking fall to a spectacular comeback. The blog explores rosy predictions, envisioning Bitcoin hitting a whopping $192,326.39 in 2030 and soaring even higher to a mind-blowing $1,194,927.30 by 2050. But, hold on! Challenges lurk ahead, like worries about the environment and unclear rules. The blog peeks into what big shots like Warren Buffett and Fidelity think about Bitcoin, adding a dash of Michael Novogratz's optimism. Robert Kiyosaki jumps in, shouting that Bitcoin is on fire and urging everyone to join the party.

Yet, a word of caution echoes – sail through the crypto journey carefully. Whether you're a pro or just curious, Bitcoin's adventure promises a future full of surprises and growth. As we wave goodbye, remember: Bitcoin's journey is as important as the destination. Happy crypto sailing!